Why? In general, companies indicate that failure mainly occurs as a result of incompatible corporate cultures.

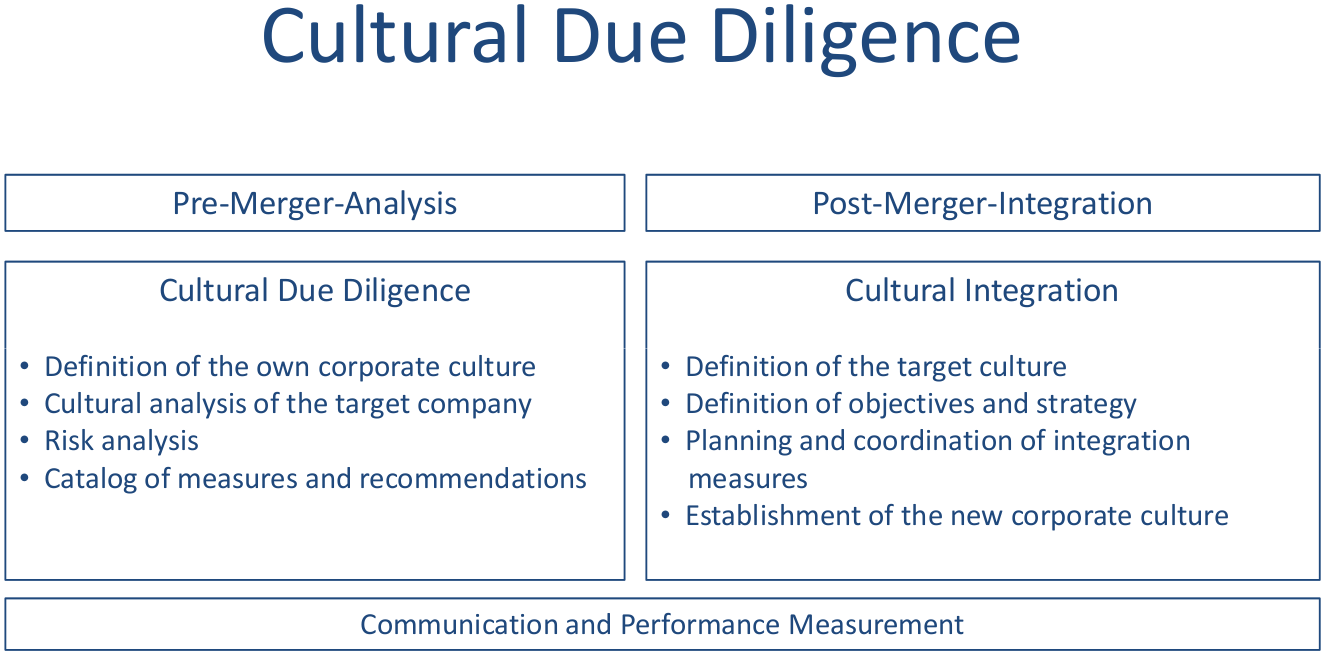

Cultural Due Diligence, in addition to a financial, legal and tax due diligence, aims to analyze, measure and take action against cultural risk potentials during M&A transactions.

ABConect works with a team of experts according to the following methodology for companies in the Pre- & Post Merger status:

- Cultures of both companies are analyzed with the help of scientifically based survey instruments and via interviews with more pragmatic, intuitive approaches.

- Cultural risks are identified and measures are set up to minimizing those risks.

- A new target culture is developed based on corporate strategy.

- Post-Merger-Integration (PMI) strategy is determined together with the executive management.

- Culture management aims to achieve a high employee acceptance for the change process.